Uganda’s media landscape continues to evolve, shaped by a small but powerful group of media proprietors whose platforms influence public discourse, political debate, and cultural trends nationwide.

A new review of ownership patterns, coupled with audience data from Nielsen Media Research, reveals both the strength of Uganda’s media personalities and the emerging shifts brought about by digital transformation.

The country’s most prominent media owners span traditional and digital platforms, creating a complex ecosystem where legacy media intersects with fast-growing online outlets.

Aga Khan Leads With Regional Media Powerhouse

At the top of the media ownership ladder is His Highness the Aga Khan, proprietor of the Nation Media Group (NMG), East Africa’s largest independent media conglomerate. NMG’s Ugandan portfolio includes Daily Monitor, NTV Uganda, Spark TV, KFM, and Dembe FM, giving the Aga Khan unmatched influence across print, television, and radio.

The Rise of Indigenous Media Moguls

Ugandan-born proprietors are also shaping the media narrative with a strong and expanding footprint.

Kin Kariisa, CEO of Next Media Services, leads one of the most influential local media groups. His platforms — NBS TV, Sanyuka TV, Nxt Radio, and several digital brands — have cemented his reputation for innovation and digital-first strategies that target younger audiences.

Digital publishers are also taking centre stage:

Muhame Giles, founder of Chimp Reports, has grown one of the country’s most visited political and security news platforms.

Sarah Kagingo, CEO of SoftPower News, is widely respected for her journalism on governance and human rights.

Remmy Asiteza, founder of Daily Express Uganda, has built an online brand known for investigative depth.

Stuart Kagoro, owner of bigeye.ug, has carved out a niche in entertainment and pop culture.

Victor Sekatawa, founder of Notifier Media, is gaining recognition for sharp, analysis-driven reporting.

These digital entrepreneurs are redefining how news is produced and consumed, especially among urban youth.

Tabloids, Radio Titans, and TV Investors Add to the Mix

Uganda’s tabloid culture remains strong under the leadership of Arinaitwe Rugyendo, Editor-in-Chief of Red Pepper, one of the country’s most provocative newspapers.

Radio and entertainment continue to be shaped by influential proprietors such as:

Nyanzi Martin Luther, whose platforms — Block FM, NUP Radio, Spark Media Uganda, Homeboyz Radio — have grown rapidly in the digital space.

Innocent Nahabwe, founder of Galaxy FM 100.2 and Galaxy TV, known for vibrant urban programming.

SK Mbuga, owner of STV Uganda, a rising private television station.

Meanwhile, Uganda’s business titans maintain strategic media investments.

Sudhir Ruparelia, through the Ruparelia Group, owns Sanyu FM, one of Uganda’s oldest private radio stations.

Patrick Bitature, founder of the Simba Group, retains interests across broadcast media aligned with his broader telecommunications portfolio.

Concentration of Ownership Raises Concerns

Despite the diversity of personalities, analysts note that Uganda’s media ownership remains highly concentrated, with a few individuals holding disproportionate influence over what information reaches the public.

Critics warn that such dominance may constrain media pluralism, limit dissenting voices, and amplify political or commercial interests over independent reporting. The growing power of digital platforms — often tied to charismatic individual founders — adds a new dimension to debates around media independence.

Audience Trends Show Digital Surge, Radio Decline

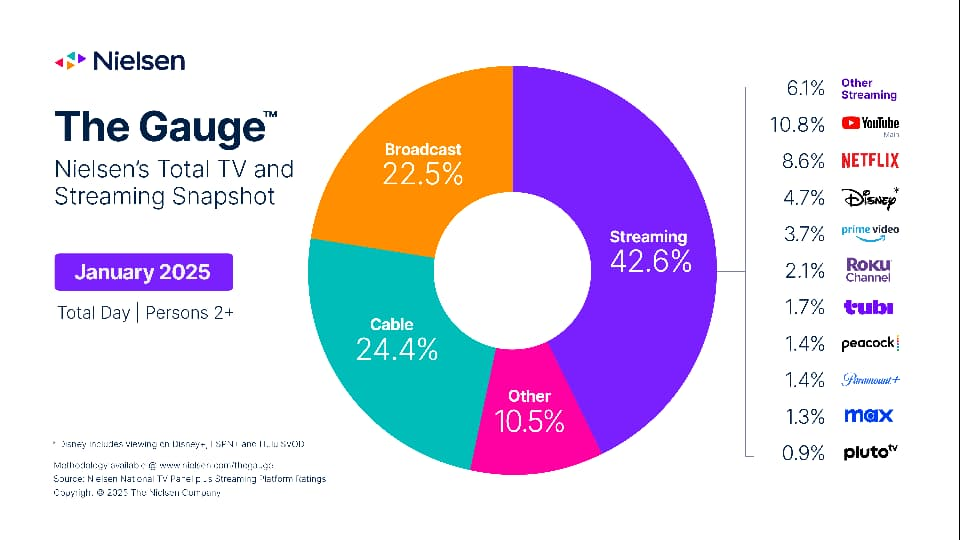

Nielsen Media Research data indicates significant shifts in how Ugandans consume information:

Radio remains the most consumed medium, but its reach has dropped from 89% in 2019 to 70% in 2024, signaling an erosion of dominance.

Television viewership dipped slightly from 38% to 37% over the same period.

Internet use — particularly social media — has surged, rising from 10% in 2019 to 26% in 2024, positioning digital media as the fastest-growing information source.

Experts attribute the digital surge to rising smartphone penetration, cheaper data bundles, and a youthful population with a growing appetite for on-demand information and entertainment.

A Media Landscape at a Turning Point

Uganda’s media sector stands at a crossroads: traditional proprietors continue to wield substantial power, yet digital innovators are rapidly reshaping the narrative. As more Ugandans shift online, the balance of influence may expand — or further consolidate — depending on how media ownership evolves.

With digital platforms maturing and audience behaviour changing, Uganda is entering a new era of media competition, innovation, and uncertainty.